My PortfolioChoice - Control your own investments

My PortfolioChoice - Control your own investments

If you’re a knowledgeable investor, you might want to have more direct control and input into your investment design selection yourself. You can set the strategy, select the funds, match the funds to your appetite for risk and watch how they perform together with your Financial Broker. And you can decide when and how to change your portfolio to stay in step with how you feel about risk and respond to how your investments are doing.

You can see from our fund range, we can offer you plenty of choice when it comes to investment styles and markets around the world. Being in charge of your own investments is a rewarding option if you have the knowledge base. But you’ll need strong investment expertise, commitment and plenty of time.

For example, you may wish to select one of our Multi-Asset funds as a core of your investment portfolio and then select some specialist equity or bond funds to complement that fund in accordance with your attitude to risk.

My PortfolioChoice has been designed with you in mind, offering flexibility, added value and a fully online service. Together with your Financial Broker you have the option to build and maintain personalised investment portfolios by choosing from our full range of funds and add-on services.

These services include:

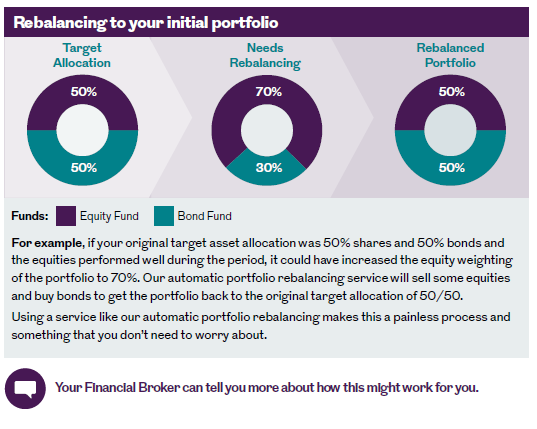

Automatic Portfolio Rebalancing: Each portfolio can be automatically rebalanced either monthly, quarterly, half yearly or yearly. This keeps your initial portfolio allocation on track as originally planned and reduces the regular amount of work needed to monitor your investments.

Flexible Lifestyle Strategies: Giving you the option to choose the level of portfolio risk, length of de-risking glidepath (how your investment glides from high risk to lower risk funds) and final retirement portfolio (what funds are in your portfolio by the time you retire). This reduces the risk associated with your investments as you near pension age, aiming to provide some protection when stock markets are falling.

The My PortfolioChoice service is available online. It provides a suite of portfolio management functions including fund switching, changing investment option, current valuations, full reporting and access to extensive fund information.

The My PortfolioChoice service is available online. It provides a suite of portfolio management functions including fund switching, changing investment option, current valuations, full reporting and access to extensive fund information.

Building your own portfolio

You’ll need to decide how much risk you want to take with your retirement savings. You can follow changes in your portfolio to make sure it doesn’t expose you to more (or less) risk as time goes on.

- Choosing funds that match how you feel about risk: The more risk you’re ready to take, the bigger the returns you could get – and the more you could lose. Lower-risk investments give you more security but lower returns.

- Automatic portfolio rebalancing: Keeping your investment portfolio on track.

Every investment portfolio needs a regular review. We know that markets go up and down, which will impact the value of your portfolio. Our automatic portfolio rebalancing system is optional and will consider these market changes and automatically realign your portfolio to match your original risk attitude and investment goals. This will help to keep your investments on track and can be set for annual or more regular reviews of your choice.